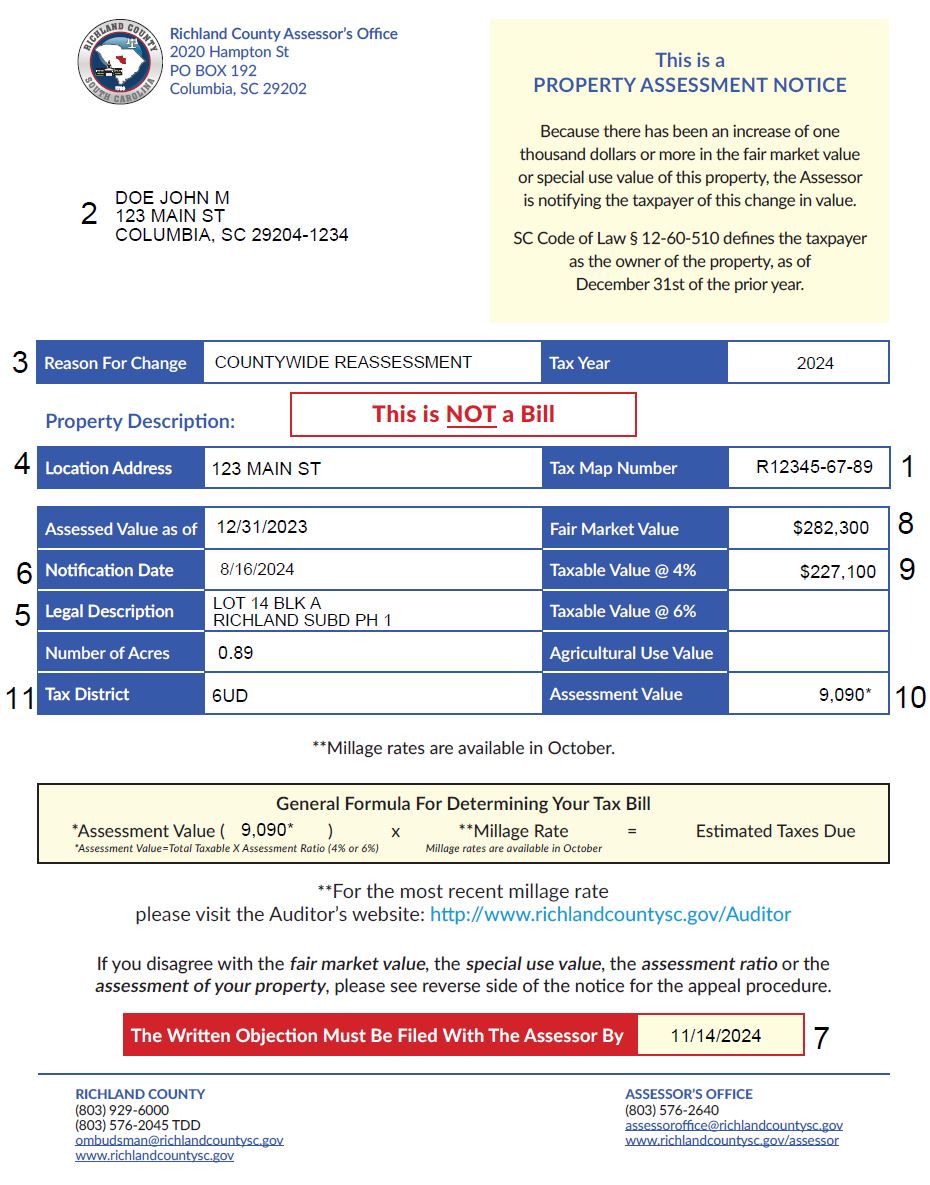

Example of Appraisal Notice

Item by item Explanation of numbers on the assessment notice.

1. The tax map number is the assessor's map numbering system, but is not to be confused with the owner's plat block and lot number.

2. The owner's name as of December 31 as required by law. The mailing address is taken from the owner's deed, or from the latest information provided by the owner.

3. A brief explanation as to why your property was appraised and the reason you were mailed the notice.

4. Location address of the property.

5. Legal description of the property.

6. Date notice is printed for mailing.

7. The appeal deadline date.

8. The actual market value as of December 31, for each of the four classes of property described on the notice. This value includes the land and any structure including pools, sheds, tennis courts, etc.

9. The taxable value at the assessment ratio.

Each and every lot or tract of real property appraised by the Richland County Assessor's Office is assigned one or more of these 4 classification codes. The definition of each assigned class is:

Class Owner Occupied Residential Property

Assessment Ratio- .04

Meaning: That portion of real estate used as the owner's legal residence to include up to 5 acres of land. An initial application to receive this rate must be made by the property owner.

Class - Market Value - Agricultural Property

Assessment -.06

Meaning: The market value of land being used for agricultural purposes. Taxes on this value are not paid until the use of the property changes from an agricultural use. The assessed value from this class, less the assessed value from the "use value agricultural" class below, generates the rollback assessment. This rollback assessment will have millage applied against it to produce the rollback taxes for the year the use changes and up to 5 previous years the property received the use value. See the section on rollback taxes on Page 3 for a further explanation of rollback taxes.

Class - Use Value - Agricultural Property

Assessment -.04/.06

Meaning: The agricultural value of land being used for agricultural purposes. The land in this class is the same property as in the "market value-agricultural" class above. An initial application to receive this use value classification must be made by the property owner. As long as the property continues to be used for agricultural purposes, taxes will be based on this value. The 4% ratio applies to privately owned property and the 6% ratio applies to corporate owned property not qualifying for the 4% ratio.

10. The assessment is the value obtained by multiplying the taxable value (Item 9) by the assessment ratio listed on the same line. This assessment will be used by taxing authorities when levying taxes. The assessment value is the combination of all assessments by taxable value.The assessment value is when multiplied by the "millage rate" to produce the "tax amount."

11. The tax district wherein the property is located. Millage rates can be different in each tax district.